StockTell

Timely insights on stocks and market trends for investors and speculators

What is StockTell?

StockTell is a system of algorithms and heuristics designed to build and manage an intelligent hypothetical portfolio of stocks through simulated buy/sell transactions. The system allows for the simulation of trading strategies and back-testing of portfolio performance across extended periods without using actual capital.

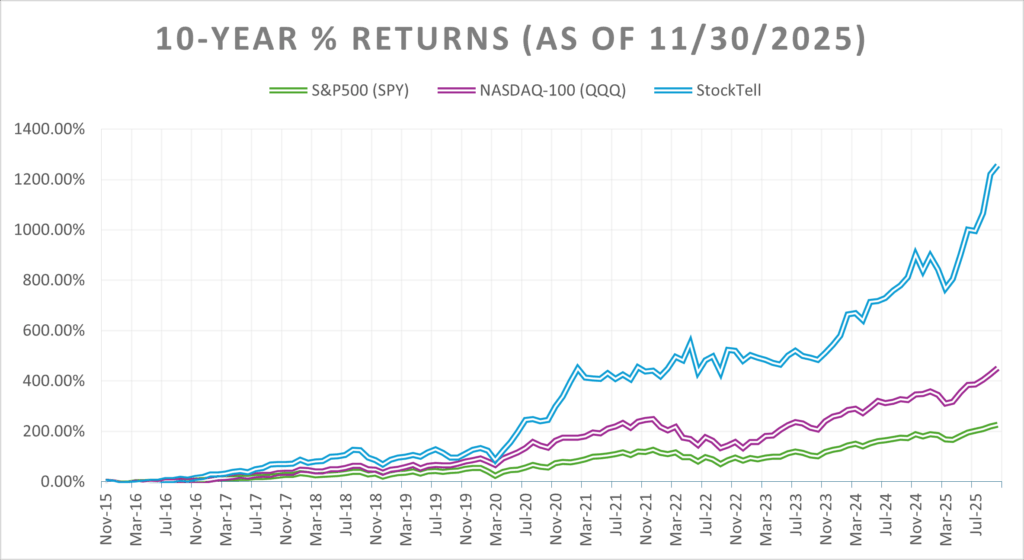

Back-testing shows that the system consistently outperforms annualized performance of standard benchmark indexes (S&P-500 and Nasdaq-100) as well as top Robo-advisors.

We believe that insights from StockTell can be used by investors and speculators to augment and accelerate growth of their own investment portfolios either manually or through software automation.

Back-Tested Performance

| Years | S&P 500 | Nasdaq 100 | StockTell |

| 1 | + 14.80 % | + 21.48 % | + 30.01 % |

| 3 | + 21.61 % | + 28.27 % | + 28.41 % |

| 5 | + 15.15 % | + 15.62 % | + 26.86 % |

| 10 | + 14.50 % | + 19.32 % | + 29.63 % |

How and Why StockTell works?

The StockTell system automatically manages a diversified hypothetical portfolio of up to 100 stocks. Diversification allows spreading bets across multiple stocks and avoids being overexposed to a specific stock, sector, or trend.

The StockTell system has three main components:

1. Stock Picking Strategies: The stock picking strategies evaluate the Universe of all stocks to make buy/sell recommendations. These strategies use heuristics to improve chances of success by evaluating numerous factors associated with a stock such as Revenue Growth, Earnings Growth, Amount of Debt, Free Cash Flow, Valuation, Market Capitalization, Stock Price Momentum, Market Direction, and overall Economic Conditions.

2. Stock Ranking Heuristics: At any given point in time, the system may pick/recommend multiple stocks to buy. The ranking heuristics rank recommended stocks according to their potential for future return and level of risk.

3. Portfolio Manager: The portfolio manager manages a hypothetical portfolio of up to 100 stocks and available cash. It periodically orchestrates stock picking strategies (say once a week or once a month), ranks them, and allocates available cash to picked stocks. When allocating cash to newly picked stocks, it aims to achieve fairness by equally weighting positions according to the level of risk they pose. The portfolio manager is also responsible for periodically re-balancing positions to raise more cash within the portfolio.

The system attempts to minimize risk by periodically closing positions that lag the overall market and/or expected rate of return. This way, the system attempts to make capital available for picking other stocks that could bring potential gains. In addition, gains from positions that substantially increase in value are periodically used to raise more cash. This way, the system attempts to compound gains by using available cash to pick new potential winners.

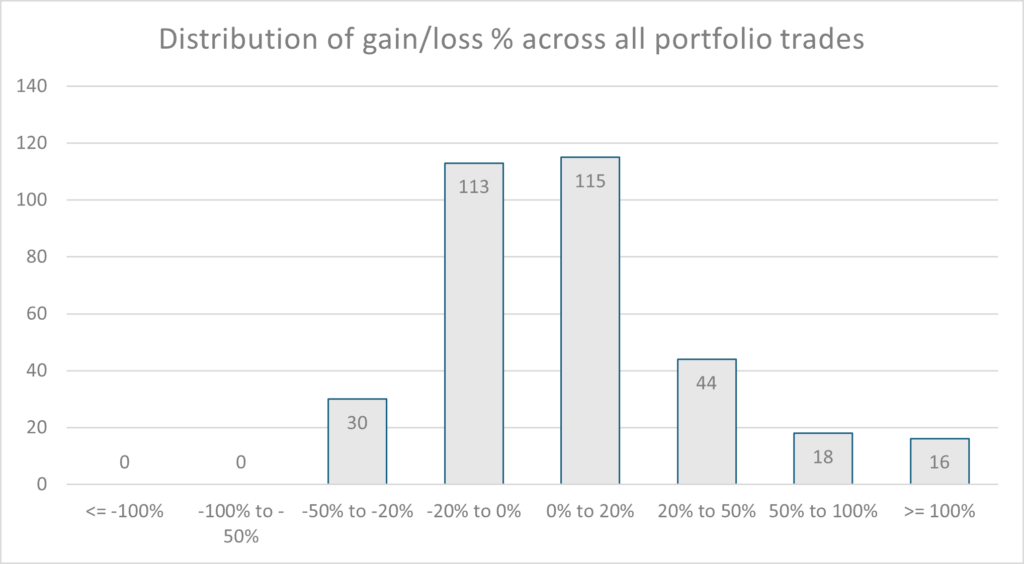

As can be seen from the “Distribution of Gain/Loss %” chart, the system’s bias is to keep winning positions and trim losing positions early thereby limiting loss per position. The system has shown success in picking numerous “multibaggers” that drive portfolio growth and allow the system to compound gains.

StockTell Portfolio Snapshot

| Start Date: | 12/31/2023 |

| Snapshot Date: | 11/30/2025 (Portfolio Age = 23 months) |

| Net Return: | 118.36% (S&P 500: 46.85%, Nasdaq 100: 52.68%) |

| Number of Open Positions: | 49 (out of a maximum of 100) |

| Number of Closed Positions: | 287 |

Note: This hypothetical portfolio is automatically managed by the StockTell system with trade simulations done once a month at the end of a month.

Top 10 Performers

| Symbol | Buy Date | Buy Price | Sell Date | Sell Price | % Gain |

|---|---|---|---|---|---|

| HOOD | 10/31/2024 | $23.49 | 11/30/2025 | $128.49 | 446.99 % |

| CRDO | 04/30/2025 | $43.05 | 312.54 % | ||

| RAIL | 05/31/2024 | $3.72 | 10/31/2024 | $14.36 | 286.02 % |

| PDYN | 10/31/2024 | $2.05 | 11/30/2024 | $6.46 | 215.12 % |

| HL | 06/30/2025 | $5.99 | 11/30/2025 | $16.82 | 181.01 % |

| NUTX | 03/31/2025 | $47.03 | 06/30/2025 | $124.49 | 164.70 % |

| NEPH | 04/30/2025 | $2.00 | 144.00 % | ||

| MMYT | 12/31/2023 | $46.98 | 01/31/2025 | $109.27 | 132.58 % |

| APP | 03/31/2025 | $264.97 | 126.24 % | ||

| NVDA | 12/31/2023 | $49.49 | 03/31/2025 | $108.36 | 118.93 % |

Distribution of Gain/Loss %

Recent Updates

Last Updated: January 11, 2026

We continue to improve performance of StockTell system. The following provides a high level summary of recent updates to the system.

December 2025: Improvements to portfolio re-balancing heuristics to raise cash.

November 2025: Added support for companies based outside of USA.

October 2025: Adaptive cost basis depending on amount of available cash in the portfolio. This allows more effective use of available cash resulting in better compounded returns.

September 2025: Improved Bullish/Bearish market direction detection. Added automatic and periodic rebalancing of portfolio to raise cash from positions that have made significant gains.